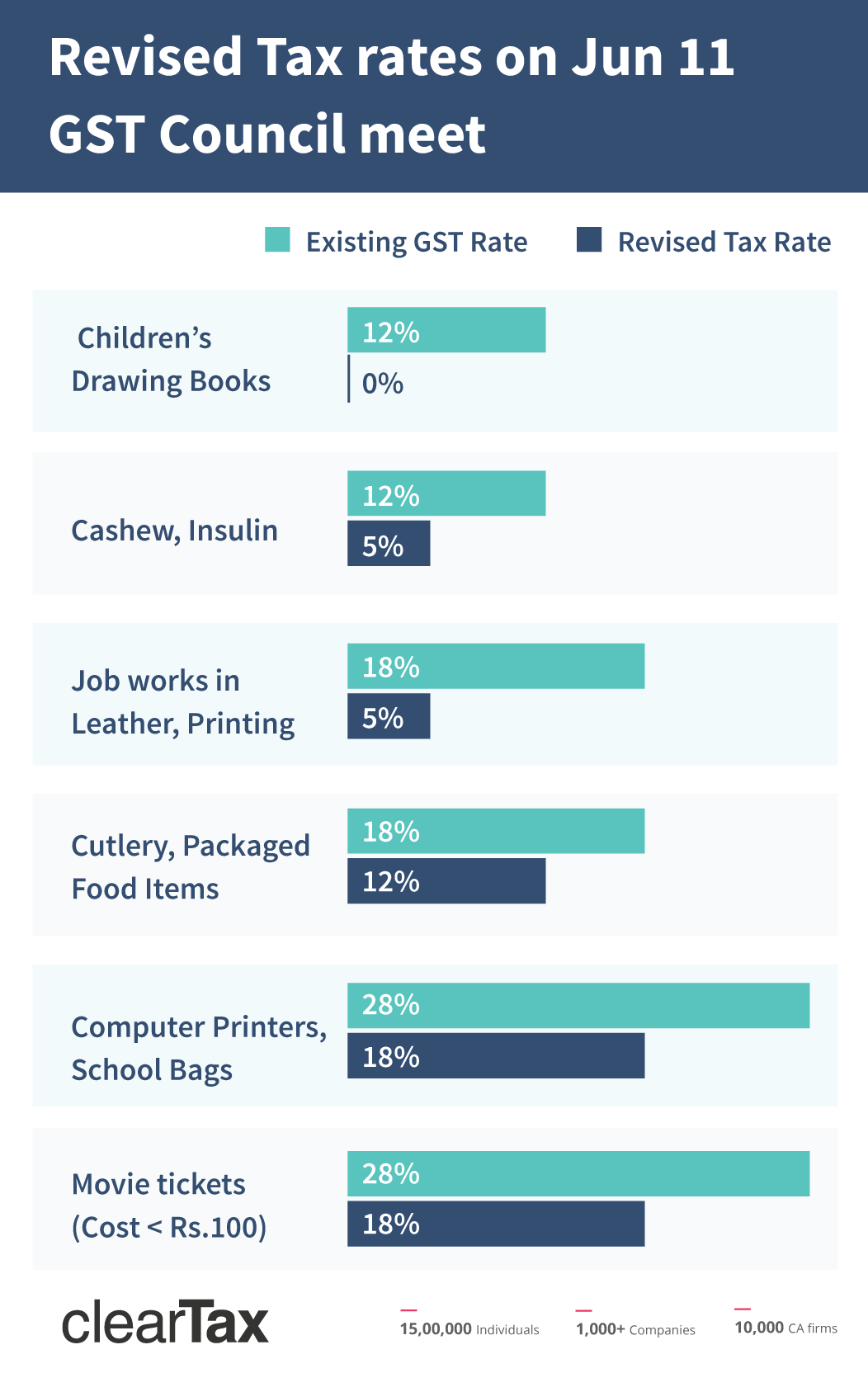

GST rates revised for 66 items when the GST Council met on 11th June 2017 (Sunday).

There have been countless recommendations from states and industries to reduce the rates on certain items. Finance Minister Arun Jaitley said that the rates were revised because the main idea behind GST rates was to maintain the rates as close to the original taxes. In some cases, this was not occurring. In some items, the reduction was required because of the changing nature of the economy and changes in consumer preference.

These items were earlier placed under high rates of GST (18-28%). On studying the list, it can be found that these items are necessities and not luxuries and so the GST council has reduced the tax rate on these essential items. For example, items like spectacles, exercise books and note books are a part of everyday life and cannot be placed in the highest tax bracket of 28% along with cars and cigarettes.

Composition Scheme

Composition scheme threshold has also been increased to 75 lakhs from 50 lakhs. Now, more businesses can opt for composition scheme and enjoy reduced taxes and lesser compliance. However, it is still not applicable for service providers. There is no clarification yet on whether the increased turnover limit for Composition levy will also apply in case of Special Category States.

GST Rates Revised for Certain Items

| Item | Earlier GST rate | New GST rate | Impact |

| Food items | | | |

| Cashew nut | 12% | 5% | |

| Cashew nut in shell | 12% | 5%(Reverse charge) | |

| Preparations of vegetables, fruits, etc. such as pickle, murabba, chutney, jam, jelly | 18%/12% | 12% | Jams and pickles are a part of staple diet of the masses and certainly not a luxury |

| Ketchup & sauces including mustard sauces | 18% | 12% | Ketchups and mustard sauces are a part of everyday food and cannot be treated as a luxury |

| Curry paste, mayonnaise and salad dressings, mixed condiments and mixed seasonings

(Fancier sauces)

| 18% | 12% | |

| Ice and snow | 12% | 5% | |

| Salt, all types | 5% | 0% | Common salt is not excisable goods.However, GST does not subsume Salt Cess (14 paise per 40 kgs of salt produced)

However, GST does not subsume Salt Cess (14 paise per 40 kgs of salt produced)

|

| Fuel | | | |

| Bio gas | 12% | 5% | Bio gas is an important source of alternative fuel especially in the villages |

| Children | | | |

| Exercise books and notebooks | 18% | 12% | |

| Children’s’ picture, drawing or colouring books | 12% | Nil | |

| Paper punchers, Staplers, Pencil sharpeners | 28% | 18% | |

| Kites | 12% | 5% | |

| Baby carriages | 28% | 18% | |

| Playing cards, board games such as chess, carom ludo, etc.

[other than video game consoles and machines]

| 28% | 12% | These are the games for masses and cannot be considered as luxury items (like play stations) |

| Swimming pools and paddling pools | 28% | 18% | |

| Entertainment | | | |

| Movie tickets costing below Rs. 100

| 28% | 18% with

Full ITC

| This will not affect moviegoers in big cities who watch movies in multiplexes |

| Medical items | | | |

| Glasses for corrective spectacles and flint buttons | 18% | 12% | Spectacles and artificial lenses are a necessity for many with poor vision and suffering from eye problems |

| Intraocular lens (replace the eye’s natural lens when it is removed during cataract surgery) | 28% | 12% |

| Spectacles, corrective | 18% | 12% |

| Insulin | 12% | 5% | This is an essential drug for diabetic patients and now taxed at 5% along with other life-saving drugs |

| Dental wax | 28% | 18% | |

| All diagnostic kits and reagents | 18% | 12% | Rates have been reduced as these are essential for medical treatments. |

| House & kitchen | | | |

| Kajal [other than kajal pencil sticks] | 28% | Nil | Kajal has been made 0 rated like Kumkum & alta |

| Kajal pencil sticks | 28% | 18% | |

| Agarbatti | 12% | 5% | Taxes have been lowered to put them almost at par with puja samagri (0%) |

| Plastic beads | 28% | 12% | |

| Plastic Tarpaulin | 28% | 18% | |

| Bags-

- School satchels and bags (not leather or composition leather)

- Toilet cases

- Hand bags and shopping bags (excluding wicker work or basket work)

- Vanity bags

| 28% | 18% | |

| Cutlery (Spoons, forks, ladles) | 18% | 12% | |

| Aluminum foil | 28% | 18% | |

| Bamboo furniture | 28% | 18% | |

| Coir mats, matting and floor covering | 12% | 5% | |

- Muddhas made of sarkanda (stools)

- Phool bahari jhadoo (brooms)

| 5% | 0% | |

| Computers and electronics | | | |

| Printers [other than multifunction printers] | 28% | 18% | |

| Set top Box for TV | 28% | 18% | |

| Computer monitors not exceeding 17 inches | 28% | 18% | |

| CCTV | 28% | 18% | GST rate has been reduced as it is now an essential item to protect security of citizens |

| Static Convertors (UPS) | 28% | 18% | |

| Other items | | | |

| Postage or revenue stamps, stamp-post marks, first-day covers, etc. | 12% | 5% | |

| Headgear and parts thereof | 28% | 18% | Rates are reduced to bring down prices of many headgear especially protective helmets |

| Rough precious and semi-precious stones | 3% | 0.25% | Rates on these items have been reduced |

GST Rates Revised for Industry and Machine Items

| Item | Earlier GST rate | New GST rate | Impact |

| Job Work

- Textile yarns & textile fabrics (not artificial fabrics)

- Jewelry making (gold and other precious metal jewelry whether plain or with diamonds, precious and semi-precious stones)

- Printing books (including braille books), newspapers, magazines- remains unchanged

- Processing leather

| 18% with Full ITC | 5% with Full ITC | Based on industry demand, GST Council decided to lower the levy on jobwork for these industries from 18% to 5%.

This is good news for those involved as it will reduce the tax burden. However, printing of newspapers remain unchanged at 5% GST.

|

| Industry items and machine parts | | | |

| Fly ash blocks | 28% | 12% | |

| Pre-cast concrete pipes | 28% | 18% | |

| Salt glazed stone ware pipes | 28% | 18% | |

| Fixed speed diesel engines | 28% | 12% | |

| Weighing machinery[not electric or electronic weighing machinery] | 28% | 18% | |

| Ball bearing, roller bearings, parts & related accessories | 28% | 18% | These are essential parts of most machines and cannot be classified as luxury items. |

| Transformers industrial electronics & electrical transformer | 28% | 18% | |

| Two-way radio (Walkie-talkie) used by defence, police and paramilitary forces etc. | 28% | 12% | These are mainly used by security forces |

| Tractor components | 28% | 18% | |

| Electrical filaments or discharge lamps | 28% | 18% | |

| Winding wires | 28% | 18% | |

| Coaxial cables | 28% | 18% | |

| Optical fiber | 28% | 18% | Used mainly in providing high speed internet |

| Instruments for measuring length by hand (measuring rods and tapes) | 28% | 18% | Measuring tapes are used in the textile and garment making industry which is a major chunk of India’s economy |

The Council will meet on June 18 to discuss lottery taxes and the e-way bill.