Tuesday, February 26, 2019

Sunday, February 24, 2019

gst billing software in kerala

Matching & Reconciliation under GST – Importance & Procedure

1. What is Matching & Reconciliation under GST?

- Differences between the amount of credit shown in GSTR- 3B and the GSTR 2A or/and

- Discrepancies between GSTR-3B and GSTR-1 or/and

- Differences in the provisional credit claimed and actual credit that is claimable. This situation arises usually during transition stages.

- The vendor has declared liability but credit is not availed in GST returns: Such credits should be availed at the earlier of due date of September returns or Annual returns.

- The vendor has not declared liability on supplies made but businesses have availed credit on such procurements in the GST returns: Businesses should follow up with the vendor to ensure that the liability is declared. Else, risks of such credits being disallowed may arise.

- Mismatch between liability declared by the vendor and credit availed: The reasons for differences should be identified and reconciled appropriately (e.g. by issuing debit notes/credit notes etc) before 30 September, 2018.

- Mistakes in the details furnished: There can be mismatch in the fields such as GSTIN of the supplier/recipient, number and date of the invoice/debit note etc. Make amendments in the GST returns of the month following the relevant month when mistakes were committed.

2. Why is GST Reconciliation required?

- Claim eligible ITC against any invoice raised in FY 2017-18.

- Any apportionment of ITC belonging to FY 2017-18, as eligible and ineligible not made earlier must be affected before the deadline.

- Declare CDNs issued against any Invoices raised in FY 2017-18.

- File Amendments to information reported in the GST Returns filed between July 2017 to March 2018.

- Taxpayers who opted into Composition scheme or the vice versa current year 2018-19, may make amendments to the information reported in the GST returns filed in FY 2017-18 prior to conversion.

3. How to do GST Reconciliation?

- Reconcile transitional ITC

- Claim ITC belonging to FY 2017-18, if not claimed earlier or reverse the ineligible ITC, if not identified and done earlier.

- Match Table of exports at 6A of GSTR-1 vis-a-vis Corresponding declaration in GSTR-3B

- Matching Table of exports at 6A of GSTR-1 vis-a-vis details of shipping bills submitted on ICEGATE

- Comparison between Annual Income Tax Return with Annual GST return

- Comparing Purchase register vis-a-vis GSTR-2A for the entire year 2017-18

- Compare GSTR-1 vis-a-vis GSTR-3B

- To Compare the ITC in GSTR-3B vis-a-vis GSTR 2A for the entire year 2017-18

4. What are the major issues with Reconciliation?

- Being Tax compliant in accordance with GST and it’s claiming of ITC?

- At fault anywhere and hence the possibility of getting notices later?

- Missing out on possible working capital by claiming lesser than what I should be claiming?

- Who are the suppliers from whom I am getting the most amount of pain reconciling and how to make it easier for them and for myself?

- The invoice number that the purchaser has recorded does not match with seller’s invoice received in 2A. Both follow a different convention.

- The purchaser may work in multiple states, and the seller has raised invoice with another GSTIN/HQ GSTIN instead of the actual purchaser GSTIN. In this case it might not reflect completely at a GSTIN level.

- The invoice date by purchaser doesn’t match with seller. Difference because of date of recording the invoices is different at both places. Mostly purchaser at fault here as they should’ve entered the same date as in Sales invoice.

- The purchaser and supplier have recorded invoices in different return periods.

- Invoice value from Supplier and Purchaser differs by a minor value because both parties have different conventions of rounding off.

- The invoice value differs at supplier and purchaser’s end in case a CN/DN is issued and it fails to match in a recon row.

- When invoice number and date do not match while only the invoice value matches between two parties.

- There are multiple invoices between a purchaser and supplier where every invoice is of same value at different dates and one of the parties has recorded invoices higher than the other. This happens in case of regular fixed supply business.

5. How to choose a tool or software to reconcile faster and ensure 100% compliance?

- The tool should be able to handle a massive amount of data.

- It should make it easy for the business owner to get data into the system for reconciliation and also take it back to his ERP post- GST reconciliation. A seamless integration here would help. It should be able to get the data into the reconciliation system from any kind of source – ERP, Excel, bill books, etc.,

- It should be able to provide deep reporting and insights which can help answer the pain points above.

- Overall, it should also make the whole process month over month seamless and largely efficient that the business owner does not feel a burden.

- It should allow for easy data sharing and collaboration between the business owner and his accountant(s).

- Given the Government GST rules might keep changing over time, the system should have the ability to evolve fast and in-line with Govt. changes. This will abstract the real problem away from the business owner and make it still seamless for them.

- It must be extremely intelligent to handle any case of missing/wrong information. It can be wrong dates, wrong invoice numbers, missing items, wrong tax rate, wrong sale value and a lot more. The system should be able to provide the most effective reconciliation in all such scenarios.

- The system should be real-time and proactive. A seamless integration to bring the invoice for reconciliation and real-time automatic application of pre-defined rules will help.

- Proactive reminders and automatics to reduce human intervention will also make the system more efficient.

- Download multi-month GSTR-2A in a click – Enabling all clients to start reconciliation of their 2A and purchases by pulling complete financial year’s 2A report.

- Intelligent and Smart Rules – ClearTax Recon uses intelligent and smart rules for you to get suggestions on what could be reconciled without taking much effort in looking for. Helps you do recon faster and easier.

- Claim Max ITC – Use ClearTax to claim 100% ITC.

- Four buckets in ClearTax GST to identify data match, mismatch type :

Thursday, February 14, 2019

gst Billing Software in kerala

Surplus Biomedical Equipment List

MedShare accepts donations of medical equipment under the following conditions:

Equipment is fully operational without need of repairs

All necessary accessories, cables, etc. are included

Acceptable equipment includes but is not limited to the following list of common equipment below.

- Equipment List:

- Anesthesia machine

- Aspiration/Suction Pump

- Autoclave / Sterilizer

- Blood Chemistry analyzer

- C-Arm system – unit, monitor, table

- Cast Saw

- Centrifuge

- Coagulation analyzer

- Colposcopy Equipment

- Computer equipment

- CPAP/Humidifier

- Defibrillator

- Dermatome

- Diagnostic Ultrasound with probes

- ECG/EKG

- Electrosurgical Unit

- Endoscopy system – scope, insufflator, light source, etc.

- Exam Light

- Exam Table

- Feeding Pump

- Fetal Doppler

- Fetal Monitor

- Hospital Bed – med/surg, birthing

- Infant Incubator

- Infant Warmer

- Infusion Pump

- IV Pole

- Lab Equipment – incubator, shaker, washer, scale

- Lab Microscope

- Lab Refrigerator

- Laryngoscope

- Nebulizer

- Nerve stimulator

- Ophthalmic Equipment – slit lamp, surgical scope

- Otoscope/Ophthalmoscope

- Oxygen Concentrator

- Oxygen Cylinder and Regulator

- Patient Scale – adult and infant

- Patient Warmer

- Portable Glucose Monitor

- Pulse Oximeter

- Sequential Compression Device

- Sphygmomanometer – aneroid and digital Stethoscope

- Stretcher

- Surgical Headlamp

- Surgical Light Head – ceiling mounted and portable

- Surgical Microscope

- Surgical Table – surgical and delivery

- Thermometer

- Traction Unit

- Ventilator

- Vital Sign Monitor

- Wheelchair

- X-Ray equipment – portable, dental, mammography

- X-ray view box

Tuesday, February 12, 2019

Billing software in kottayam

Monday, February 11, 2019

Billing software in pathanamthitta

What is GSTR 2A?

| Return | Filed by |

| GSTR 1 | Regular registered seller |

| GSTR-5 | Non-resident |

| GSTR 6 | Input Service Distributor |

| GSTR 7 | Person liable to deduct TDS |

| GSTR 8 | Ecommerce |

How is GSTR 2A different from GSTR-2?

How to file GSTR-2A?

How can I correct my seller’s mistakes in GSTR-2A?

What happens if my seller delays in filing GSTR-1?

Comparison between GSTR – 2A and GSTR – 3B

| Details | Integrated tax | Central tax | State/ UT tax | Cess |

| A) ITC available | ||||

| B) ITC reversed | ||||

| C) Net ITC available [A-B] | ||||

| D) INELIGIBLE ITC |

- GST authorities have issued notices to a large number of taxpayers asking them to reconcile the ITC claimed in a self-declared summary return Form GSTR – 3B and auto-generated Form GSTR – 2A. Such notices are issued in Form GST ASMT – 10. The taxpayer would be required to reply to such notices or pay the differential amount.

- Action has also been taken against evaders claiming ITC on basis of fake invoices.

- Reconciliation ensures that credit is being claimed only in respect of the tax which has been actually paid to the supplier.

- Ensures that no invoices have been missed/ recorded more than once etc.

- In case the supplier has not recorded the outward supplies in Form GSTR – 1, communication can be sent out to the supplier to ensure that the discrepancies are corrected.

- Errors committed while reporting details in GSTR-1 by suppliers or GSTR-3B by recipients can be rectified.

- Credit of IGST claimed on the import of goods

- Credit of IGST on the import of services

- Credit of GST paid on reverse charge mechanism etc.

- Transitional credit claimed in TRAN – I and TRAN – II.

- ITC for goods and services received in FY 2017 – 18 but availed in FY 2018 – 19.

Details of GSTR-2A

PART A

Part B

PART C

Gst billling software in kerala

What is an eWay Bill?

EWay Bill is an electronic waybill for movement of goods to be generated on the eWay Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in Alternatively, Eway bill can also be generated or cancelled through SMS, Android App and by site-to-site integration through API. When an eway bill is generated, a unique Eway Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.2.When Should eWay Bill be issued?

eWay bill will be generated when there is a movement of goods in a vehicle/ conveyance of value more than Rs. 50,000( either each Invoice or in (aggregate of all Invoices in a vehicle/ Conveyance)# ) –- In relation to a ‘supply’

- For reasons other than a ‘supply’ ( say a return)

- Due to inward ‘supply’ from an unregistered person

- A supply made for a consideration (payment) in the course of business

- A supply made for a consideration (payment) which may not be in the course of business

- A supply without consideration (without payment)In simpler terms, the term ‘supply’ usually means a:

- Sale – sale of goods and payment made

- Transfer – branch transfers for instance

- Barter/Exchange – where the payment is by goods instead of in money

Tuesday, February 5, 2019

Best GST billing software in kerala

- If the number of sales invoice is more than 500, GST Offline Utility has to be downloaded and return file needs to be generated from this offline utility.

- No option to perform bulk action on invoices

- HSN wise summary has to be manually filled in

- Bulk import and updating of sales invoices

- Upload sales details at a click of a button. No need to login to GST Portal.

- Autofill HSN wise summary based on sales details imported by you.

Here is a step-by-step guide on how to file GSTR-1 on GST Portal:

GSTR-1 – Invoice Details

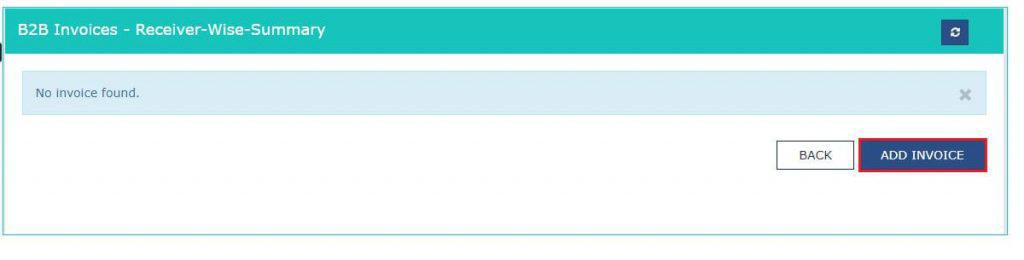

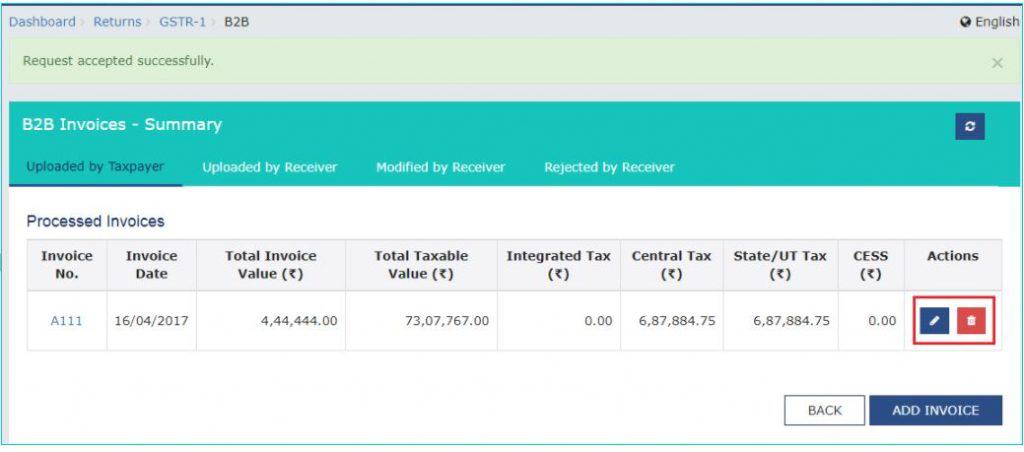

1. 4A, 4B, 4C, 6B, 6C – B2B Invoices

- Select the check box for Deemed Exports, SEZ Supplies with Payment or SEZ Supplies Without Payment, if applicable.

- Enter the receivers GSTIN/ UIN . Once this is done the Receivers Name, POS and Supply Type will be auto populated.

- Enter the Invoice No., Invoice Date and Invoice Value

- In case the supply attracts reverse charge or supply is through e-commerce operator select the check box.

- Enter the Taxable Value of supplies made in the taxable value field. Based on inter-state or intra-state transactions CGST and SGST or IGST will appear in the amount of tax field. The Amount of tax is auto calculated based on the taxable value entered.

- Click on Save once all the details are entered.

2. 5A, 5B – B2C (Large) Invoices

- In the POS field select the state where the goods are delivered in the drop down. The supply type will be auto-populated based on this.

- Enter the Invoice No., Invoice Date, Total Invoice Value.

- In case the supply is made through e-commerce operator tick the checkbox ‘Is E-commerce’.

- Enter the Taxable Value of supplies made in the taxable value field. Based on inter-state or intra-state transactions CGST and SGST or IGST will appear in the amount of tax field. The Amount of tax is auto-calculated based on the taxable value entered.

- Click on Save once the details are entered.

3. 9B – Credit / Debit Notes (Registered)

- Enter the Receivers GSTIN. The name will get auto populated.

- Enter the Debit/ Credit Note no. and Date.

- In the Original Invoice No. and Date field enter the date and number of the invoice against which the debit note or credit note is issued.

- In the Note Type drop down select whether the details added are for a debit note, credit note or refund voucher.

- Enter the Note Value and the Reason for Issuing Note.

- If the original invoice was issued before 1st July 2017 tick on the check box Pre- GST Regime.

- Enter the Taxable Value of goods or services in the taxable value field. Based on inter-state or intra-state transactions CGST and SGST or IGST will appear in the amount of tax field. The Amount of tax is auto calculated based on the taxable value entered.

- Click on save once the details are entered.

4. 9B – Credit / Debit Notes (Unregistered)

- Choose the right type from the drop down like B2CL, export without payment, etc.

- Enter the Debit/ Credit Note no. and Date.

- In the Original Invoice No. and Date field enter the date and number of the invoice against which the debit note or credit note is issued.

- In the Note Type drop down select whether the details added are for a debit note, credit note or refund voucher.

- Enter the Note Value and the Reason for Issue of Note.

- If the original invoice was issued before 1st July 2017 tick on the check box Pre- GST Regime.

- Enter the Taxable Value of goods or services in the taxable value field. Based on inter-state or intra-state transactions CGST and SGST or IGST will appear in the amount of tax field. The Amount of tax is auto calculated based on the taxable value entered.

- Click on save once the details are entered.

5. 6A – Exports Invoices

- Enter the Invoice No., Invoice Date and Port Code details in the respective fields

- Now enter details of Shipping Bill Number and Date

- In the Total Invoice Value field, enter the total amount of all the goods or services supplied

- In the GST Payment select from the dropdown if GST is paid or not.

- Enter the Taxable Value. IGST will be auto calculated

- Click on Save.

GSTR-1 – Other Details

1. 7- B2C Others

- Select Place of Supply (State Code) where supply was delivered. The Supply Type field gets auto populated

- Enter the Value of Taxable supplies made

- Select Rate of GST applicable

- Enter GSTIN of e-commerce operator(if any)

- Click on Save

2. 8A, 8B, 8C, 8D – Nil Rated Supplies

- Inter-state supply to a registered dealer

- Inter-state supply to an unregistered dealer

- Intra-stare supply to a registered dealer

- Intra-stare supply to an unregistered dealer

3. 11A(1), 11A(2) – Tax Liability (Advances Received)

- Select Place of Supply (State Code) where supply was delivered. The Supply Type field gets auto populated

- Enter the Gross Advance Received. IGST or CGST and SGST will be calculated automatically based on supply type(inter-state or intra-state)

- Click on Save

4. 11B(1), 11B(2) – Adjustment of Advances

- From the drop-down select the POS i.e. state in which the outward supply is made. The supply type will get pre-filled based on the POS selection

- Enter the amount received as an advance in Gross Advance Adjusted field. The IGST or CGST and SGST will be auto calculated

- Click on Save button

5. 12 – HSN-wise-summary of outward supplies

- HSN Code of outward Supplies

- Description of the outward supplies

- In the ‘UQC’ drop-down select the quantity of the supplies. Eg – KGs, Liters, etc.

- Enter the Total Quantity, Total Value and Total Taxable Value of the outward supplies

- Now enter the IGST or CGST and SGST based on the type of sale made viz a viz inter-state or intra-state

- Click on Add and on the next page click on save button.

6. 13 – Documents Issued

Final Step

Subscribe to:

Posts (Atom)

GST Simplified Billing Software

ASTER BILLING Here are all the changes in GST rates on goods and what will get cheaper after the new rates come into effect: 1. Reduc...

-

BREAKING DOWN 'Tax Liability' A tax liability is the amount of taxation that a business or an individual incurs based on curre...

-

What is a GST invoice and who should issue one? The GST system has replaced the invoices such as tax invoice, excise invoice and retail ...

-

Accounts and Other Records Every registered person is required to keep and maintain all records at his principal place of business. Wh...